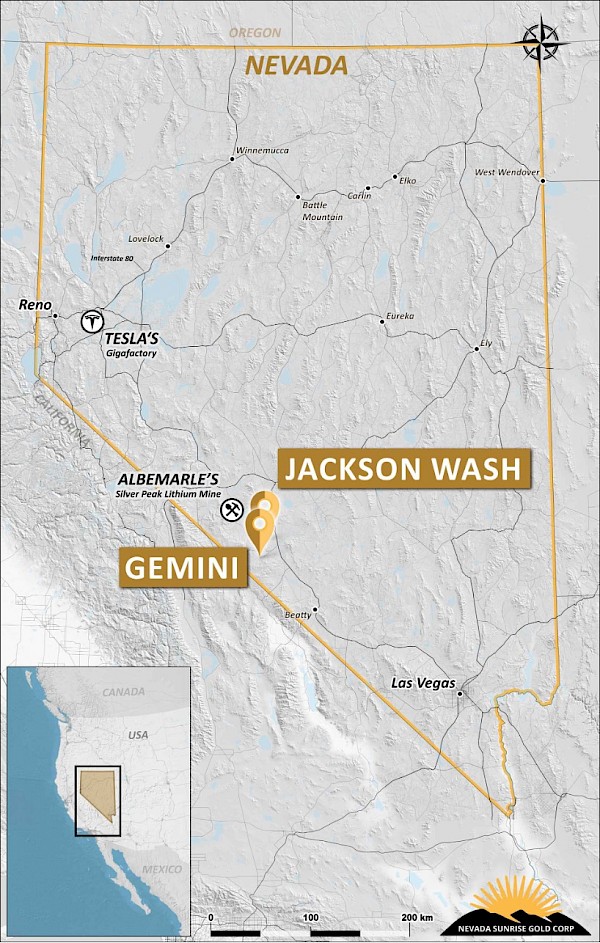

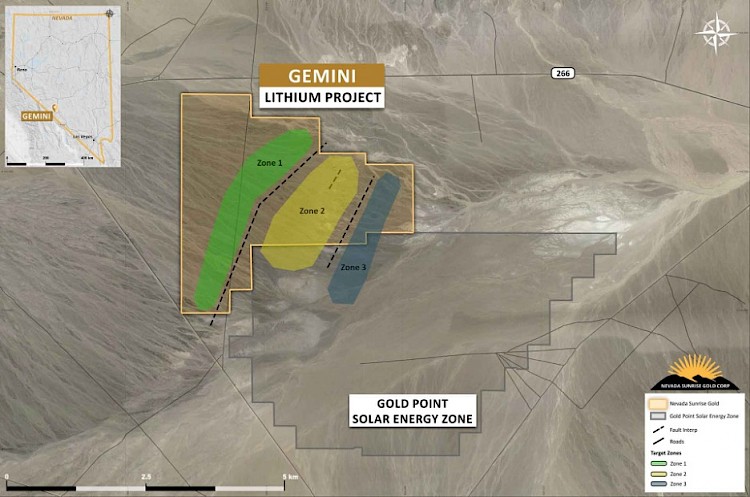

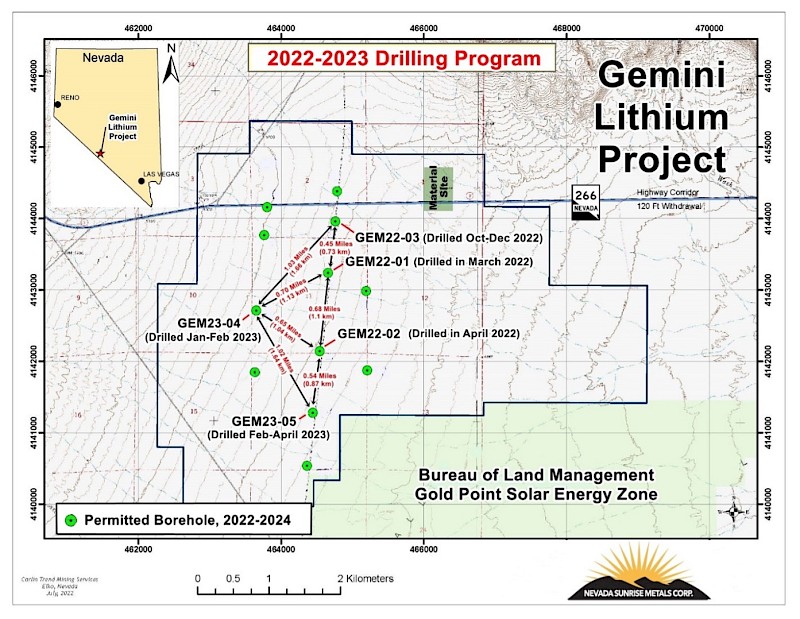

The Gemini Lithium Project (“Gemini”) consists of 280 unpatented lode claims totaling approximately 5,600 acres (2,266 hectares) and located in the Lida Valley approximately 6 miles (10 kilometres) east of the town of Lida, Nevada. Nevada Sunrise acquired Gemini by claim staking in 2015 with no applicable royalties and currently holds a 100% interest in the project. Gemini is situated adjacent to the Gold Point Solar Energy Zone, a Bureau of Land Management land reserve set aside for solar and wind power generation projects until 2033.

Gemini Lithium Project, Lida Valley, Nevada

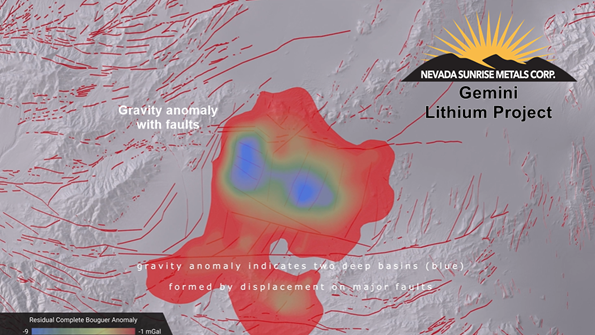

The Lida Valley is a flat, arid basin with a similar geological setting to the better-known Clayton Valley basin where Albermarle Corporation operates the Silver Peak lithium brine mine, which has operated continuously since 1966. In 2015, Nevada Sunrise adopted an exploration strategy targeting desert basins, or playas, that exhibit similar geological and geophysical characteristics to the Clayton Valley basin where brines and sediments containing economic contents of lithium are known to accumulate in sub-basins. Such sub-basins can be delineated by gravity surveys that detect strong gravity lows.

Future exploration at Gemini is complemented by the Company’s 80.09 acre/feet/year water right, a pre-requisite for the exploration and development of lithium brine projects in Nevada.

Previous ground gravity surveys in the Lida Valley area were widely-spaced and limited in scope, however in 2012 and 2013 a geological research team led by Dr. John Oldow of the University of Texas, Dallas collected approximately 500 gravity measurements along 7 transects crossing the Lida Valley. The detailed gravity survey results indicated significant gravity lows within two, faulted sub-basins approximately 7 kilometres (4.5 miles) apart, each interpreted to be hundreds of metres deep. Nevada Sunrise made the decision to acquire claims covering the available land after reviewing the geophysical results in conjunction with favourable local geology, namely late Miocene felsic volcanic tuffs adjacent to Gemini. These rocks provide the source of lithium for trapped, lithium-rich saline ground-waters (brine) within the sub-basins. Drill pads, access roads and an active drilling permit are in place at Gemini.

Two separate follow-up TDEM surveys over Gemini carried out in early 2016 by Nevada Sunrise each detected conductive zones within the sub-basins interpreted to represent conductive zones at depth located well below the non-conductive alluvium at and near surface.

TDEM Survey at Gemini, 2016

A conductive layer 150-250 metres deep appears to cover most of Gemini and several isolated strong conductive zones were interpreted at depths from 400 to 600 metres. The conductive layers and zones are indicative of conductive sediments and possible brine solutions in porous aquifers and traps within each sub-basin.

Gemini Project Geophysical Interpretation July 2016

2022-2023 Drilling Program

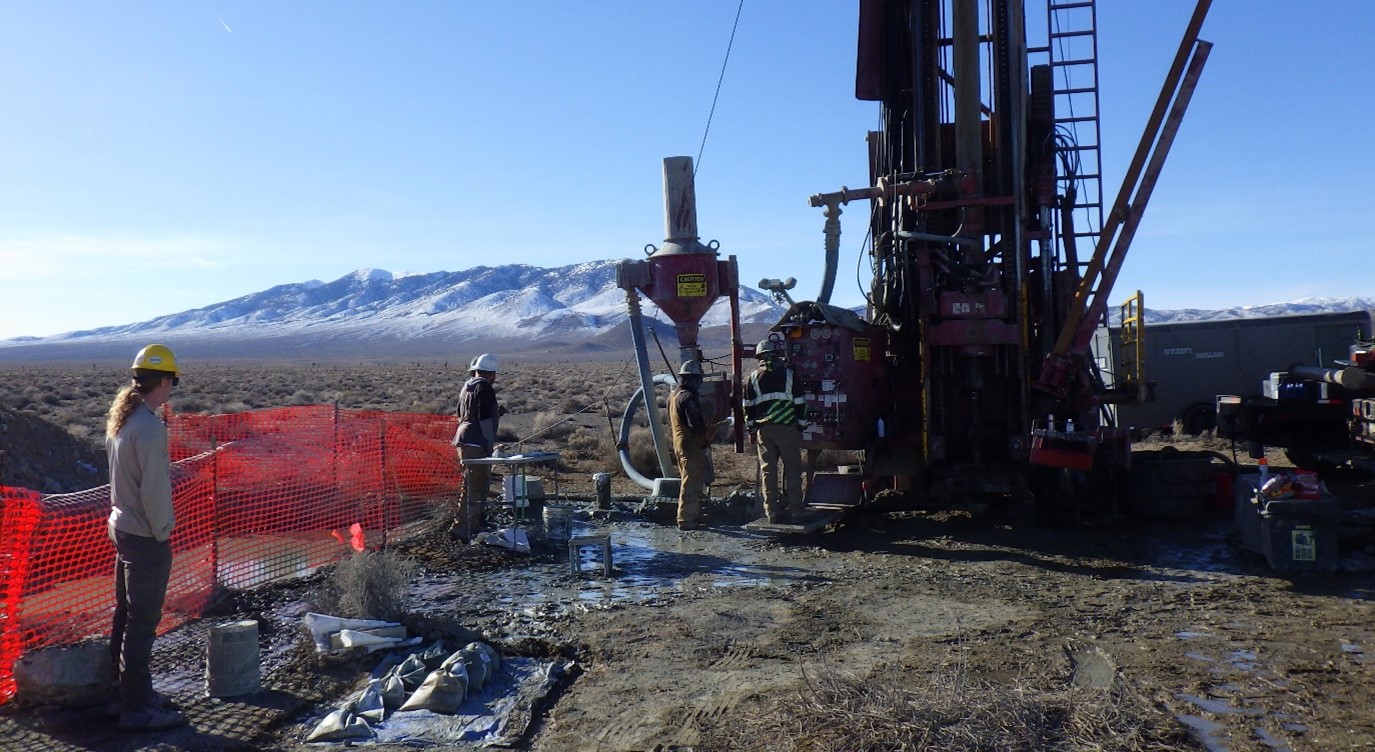

On March 15, 2022, Nevada Sunrise announced the commencement of the inaugural drilling program at Gemini of up to 2,020 feet (615,85 metres) of reverse circulation drilling in up to two holes to test targets for lithium brines and lithium-in-sediments.

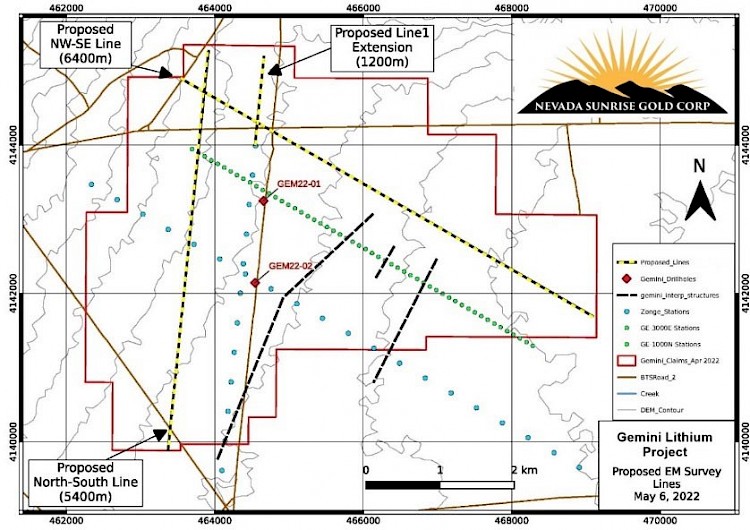

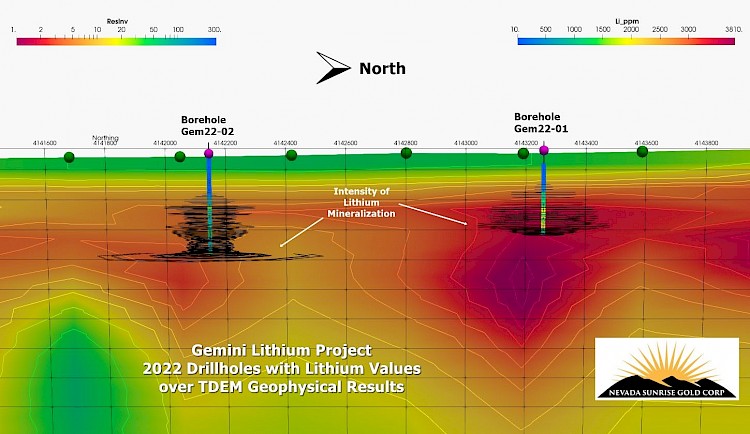

On April 21, 2022, the Company announced that lithium mineralization had been intersected over significant widths in the 2022 drilling program. Two boreholes were completed for a total of 2,020 feet (615.85 metres) on drill sites located within a defined gravity low that hosts conductive layers detected by historical ground time-domain electromagnetic (“TDEM”) surveys (see Figure 1 below).

The results from the first two boreholes at Gemini represent a new discovery of lithium-bearing sediments in the western Lida Valley, which has not been historically drill tested for lithium mineralization. Lithium-in-sediment values were significant:

- GEM22-01 averaged 1,203.41 parts per million (“ppm”) lithium over 580 feet (176.83 metres), from 320 to 900 feet (97.56 to 274.39 metres) including 1.578.19 ppm lithium over 300 feet (91.46 metres) from 480 to 780 feet (146 to 237.8 metres).

- Gem22-02 averaged 1,101.73 parts per million (“ppm”) lithium over 730 feet (222.56 metres) from 390 to 1,120 feet (118.90 to 341 metres), including 2,217.69 ppm lithium over 130 feet (39.63 metres) from 990 to 1,120 feet ( 301.83 to 341.46 metres) and 3,304 ppm lithium over 50 feet (15.24 metres) from 1,070 to 1.120 feet (326.22 to 341.46 metres)

Figure 1: TDEM Survey Results Showing Conductive Zones and Drill Holes at Gemini

Drilling at Gemini Project - March 2022

Table 1. Final analytical results from boreholes GEM22-01 and GEM22-02

|

GEM22-01 Lithium Mineralization |

|||||||

|---|---|---|---|---|---|---|---|

|

Sample Interval |

Thickness |

Lithium |

|||||

|

Feet |

Metres |

Feet |

Metres |

||||

|

From |

To |

From |

To |

||||

|

320 |

900 |

97.56 |

274.39 |

580 |

176.83 |

1,203.41 |

|

|

including |

|||||||

|

480 |

780 |

146.34 |

237.8 |

300 |

91.46 |

1,578.19 |

|

|

GEM22-02 Lithium Mineralization |

|||||||

|

390 |

1120 |

118.90 |

341.46 |

730 |

222.56 |

1,101.73 |

|

|

including |

|||||||

|

490 |

560 |

149.39 |

170.73 |

70 |

21.34 |

1,227.15 |

|

|

990 |

1120 |

301.83 |

341.46 |

130 |

39.63 |

2,217.69 |

|

|

including |

|||||||

|

1070 |

1120 |

326.22 |

341.46 |

50 |

15.24 |

3,304.34 |

|

1. Samples are a composite of material collected from the rotary splitter in the RC drilling rig, which produces a continuous, representative 3 to 5 kilogram sample for each sample interval.

Fig. 2: Gemini Lithium Project 2022 TDEM Survey Plan

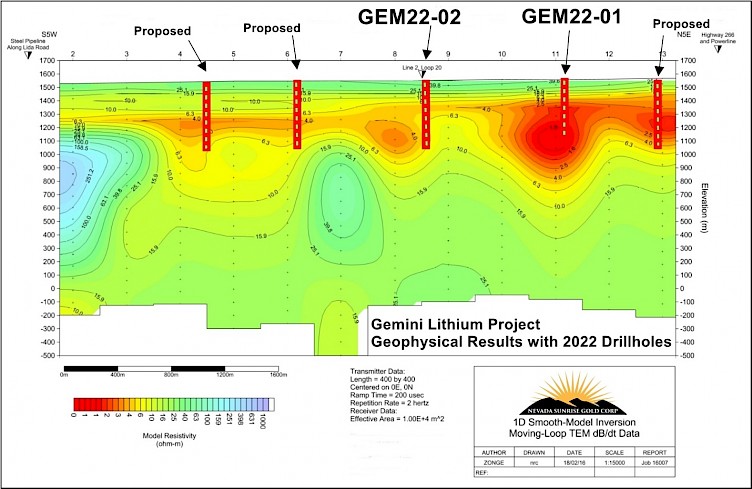

The 2022 geophysical survey was designed to outline the possible lateral extent of the conductive, lithium-bearing clay layers within a historical gravity low that were intersected in drillholes GEM22-01 and GEM22-02. A total of 13.0 line kilometres were carried out in three new survey lines as shown in Figure 1.

The TDEM moving loop survey employed 400 metre by 400 metre loops to collect data along new survey lines parallel to the 2016 survey lines, which had detected a highly-conductive layer (see Figure 2 above). The northern and western limits of the conductive clay layer at Gemini were historically not well-defined and the 2022 survey results have added to the Company’s geological knowledge of the conductive zones. In July 2022, and based on those results, Nevada Sunrise submitted an amended drilling plan to the Bureau of Land Management (“BLM”) for the permitting of new drill targets at Gemini. The expanded permit was received in August 2022, for up to 12 boreholes..

Gemini Lithium Project - Conductive Zone with 2022 Drillholes and Lithium Values

These 2022 analytical results and preliminary research by the Company suggest that the Gemini lithium deposit is an example of the claystone deposit model situated in a closed arid basin, similar to lithium deposits found in the Clayton Valley and at other sedimentary-hosted lithium deposits in Nevada.

Phase 2 Drilling Program

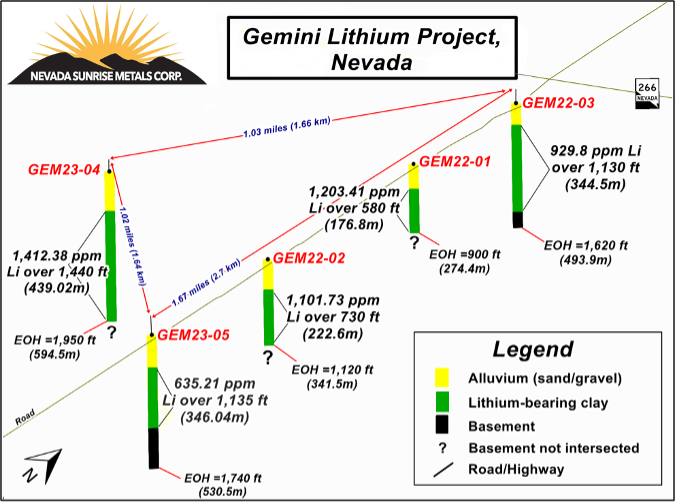

On August 15, 2022, Nevada Sunrise announced the receipt of an amended exploration permit from the BLM for Gemini. The amended permit increases the number of proposed borehole locations to twelve (12), which includes the two successful boreholes that intersected significant lithium values drilled during the Company’s maiden drilling program in March and April 2022.

Nevada Sunrise engaged O’Keefe Drilling Company of Butte, Montana as the drilling contractor for the program, which commenced on October 19, 2022. Up to six boreholes were planned In Phase 2 for an estimated total of 8,000 feet (2,439 metres) of drilling. The exploration goals for the drilling program are: (1) test lithium-bearing brine and sediments at greater depths than previous boreholes GEM22-01 and GEM22-02, and (2) determine the lateral extent of lithium-mineralized brine and sediments identified in the two previous Gemini drill holes. Drill hole locations may be amended or revised during the Phase 2 program as results warrant.

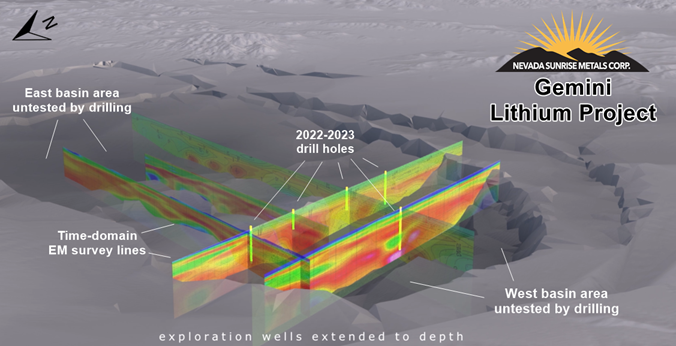

Geophysical TDEM Model Showing Conductive Zones 2022 and 2023 Drill Holes at Gemini

The first hole of the Phase 2 program, GEM22-03, was completed in mid-December 2022 and drilling of the second Phase 2 hole, GEM23-04, began in January 2023. GEM23-04 targeted a strong conductive anomaly approximately 0.65 miles (1.04 kilometres) northwest of hole GEM22-02 and is planned to test the deepest part of the Gemini basin to an estimated depth of 2,000 feet (609.75 metres).

On February 7, 2023, Nevada Sunrise announced the final geochemical analyses for lithium mineralization in sediments and groundwater collected from borehole GEM22-03.

Highlights of GEM22-03

- Borehole GEM22-03 intersected 929.80 parts per million (“ppm”) lithium-in-sediment over 1,130 feet from 280 feet (85.37 metres) to 1,410 feet (344.51 metres), including 1,342.20 ppm lithium over 350 feet (106.71 metres) and 1,955 ppm lithium over 30 feet (9.15 metres) (see table below for greater detail on mineralized intervals);

- GEM22-03 was completed at a location approximately 0.47 miles (0.76 kilometres) north of GEM22-01 and 1.14 miles (1.83 kilometres) north of GEM22-02, thereby successfully extending the lithium mineralized zone to the north.

Final Lithium-in-Sediment analytical results from borehole GEM22-03

|

Gemini Lithium Project - Borehole GEM22-03 |

||||||

|

Depth Interval |

Thickness |

Lithium (Weighted average: ppm) |

||||

|

From (feet) |

To |

From (metres) |

To (metres) |

Feet |

Metres |

|

|

280 |

1,410 |

85.37 |

429.88 |

1,130 |

344.51 |

929.80 |

|

including: |

||||||

|

280 |

630 |

85.37 |

192.07 |

350 |

106.71 |

1,342.20 |

|

including: |

||||||

|

400 |

430 |

121.95 |

131.10 |

30 |

9.15 |

1,856.94 |

|

and: |

||||||

|

470 |

500 |

143.29 |

152.44 |

30 |

9.15 |

1,955.73 |

|

and: |

||||||

|

560 |

600 |

170.73 |

182.93 |

40 |

12.20 |

1,543.79 |

Note: Sediment samples are a composite of material collected from the rotary splitter in the RC drilling rig, which produces a continuous, representative 3 to 5 kilogram sample for each sample interval. All depth measurements reported, including sample and interval widths are down-hole. As holes at Gemini are oriented vertical and geologic stratigraphy is primarily horizontal to sub-horizontal, downhole measurements are assumed to be close to true thickness.

GEM23-04 Drilling in Progress, February 2023

On March 28, 2023, Nevada Sunrise announced final geochemical analyses for lithium mineralization in sediment and groundwater samples collected from borehole GEM23-04. Drilling of borehole GEM23-04 was completed to a depth of 1,950 feet (594.51 metres), which represents the deepest hole drilled to date at Gemini.

Video GEM23-04 Drilling in Progress, February 2023

Highlights of GEM23-04

- Borehole GEM23-04 intersected 1,412.38 parts per million (“ppm”) lithium-in-sediment over 1,440 feet (439.02 metres) from 510 feet (155.49 metres) to 1,950 feet (594.51 metres), including 3,556.82 ppm lithium over 110 feet (33.54 metres) and 4,329.60 ppm lithium over 30 feet (9.15 metres) (see Table 1 below).

Table 1. Final Results of Lithium-in-Sediment Samples for Borehole GEM23-04

|

Gemini Lithium Project - GEM23-04 Sediment Sample Results |

||||||

|---|---|---|---|---|---|---|

|

Interval |

Thickness |

Lithium (Weighted average: ppm) |

||||

|

From |

To |

From |

To |

Feet |

Metres |

|

|

(feet) |

(feet) |

(metres) |

(metres) |

|||

|

510 |

1950 |

155.49 |

594.51 |

1440 |

439.02 |

1,412.38 |

|

including: |

||||||

|

1270 |

1380 |

387.20 |

420.73 |

110 |

33.54 |

3,556.82 |

|

including: |

||||||

|

1350 |

1380 |

411.59 |

420.73 |

30 |

9.15 |

4,329.60 |

|

and: |

||||||

|

1,500 |

1,950 |

457.32 |

585.37 |

450 |

137.20 |

1,665.45 |

|

including: |

||||||

|

1,520 |

1,650 |

463.41 |

503.05 |

130 |

39.63 |

3,004.58 |

|

including: |

||||||

|

1,550 |

1,590 |

472.56 |

484.76 |

40 |

12.20 |

3,453.98 |

GEM23-04 was completed at a location approximately 0.73 miles (1.17 kilometres) southwest of GEM22-01 and 0.65 miles (1.04 kilometres) northwest of GEM22-02, thereby successfully extending the lithium mineralized zone at Gemini to the west.

On April 19, 2023, Nevada Sunrise announced the completion of its Phase 2 drilling program at Gemini. Three holes were completed in Phase 2 for a total of 5,310 feet (1,618.9 metres), bringing the total number of holes drilled by the Company at Gemini to five, totaling 7,330 feet (2,234.76 metres). The Gemini drilling program began in March 2022 and was successful in intersecting lithium mineralization in every hole, both in sediments and in groundwater.

GEM23-05, the final Phase 2 borehole, was completed to depth of 1,740 feet (530.49 metres) at a location approximately 0.52 miles (0.83 kilometres) south of borehole GEM22-02 and 1.04 miles (1.67 kilometres) southeast of borehole GEM23-04. After passing through Quaternary alluvium, the borehole intersected green clay from 440 to 540 feet (134.15 metres to 164.63 metres) followed by varying stratigraphies of green, brown and sandy clays and white ash tuffs until Interpreted basement contact was made at 1,575 feet (480.18 metres) in a rhyolite flow sequence, which provides further definition of the depth of the southern edge of the Gemini sedimentary basin.

GEM23-05 intersected 635.21 ppm lithium-in-sediment over 1,135 feet (346.04 metres) from 440 feet (134.15 metres) to 1,575 feet (480.18 metres), including 1,096.16 ppm lithium over 360 feet (109.76 metres) and 1,308.42 ppm lithium over 180 feet (54.88 metres) (see Table 1 below).

| Table 1. Gemini Lithium Project, Phase 1 & Phase 2 Drilling Results: Lithium-in-Sediments | |||||||

| Depth Interval | Thickness | Lithium Weighted Average (ppm) |

|||||

| Hole Number |

From (feet) |

To (feet) |

From (metres) |

To (metres) |

Feet | Metres | |

| GEM22-01 | 320 | 900 | 97.56 | 274.39 | 580 | 176.83 | 1,203.41 |

| including: | 480 | 780 | 146.34 | 237.80 | 300 | 91.46 | 1,578.19 |

| GEM22-02 | 390 | 1,120 | 118.90 | 341.46 | 730 | 222.56 | 1,101.73 |

| including: | 990 | 1,120 | 301.83 | 341.46 | 130 | 39.63 | 2,217.69 |

| and: | 1,070 | 1,120 | 326.22 | 341.46 | 50 | 15.24 | 3,304.34 |

| GEM22-03 | 280 | 1,410 | 85.37 | 429.88 | 1,130 | 344.51 | 929.80 |

| including: | 280 | 630 | 85.37 | 192.07 | 350 | 106.71 | 1,342.20 |

| and: | 470 | 500 | 143.29 | 152.44 | 30 | 9.15 | 1,955.73 |

| GEM23-04 | 510 | 1,950 | 155.49 | 594.51 | 1,440 | 439.02 | 1,412.38 |

| including: | 1,270 | 1,380 | 387.20 | 420.73 | 110 | 33.54 | 3,556.82 |

| and: | 1,350 | 1,380 | 411.59 | 420.73 | 30 | 9.15 | 4,329.60 |

| GEM23-05 | 440 | 1,575 | 134.15 | 480.18 | 1,135 | 346.04 | 635.21 |

| including: | 850 | 1,210 | 259.15 | 368.90 | 360 | 109.76 | 1,096.16 |

| and: | 950 | 1,130 | 289.63 | 344.51 | 180 | 54.88 | 1,308.42 |

3-D View of Gemini Lithium Mineralization in Phase 1 & Phase 2 boreholes

Nevada Sunrise believes that the southern and western parts of the Gemini basin are highly prospective for additional lithium mineralization and that further drilling could eventually define a large lithium resource. In July 2023, the Company engaged ABH Engineering Inc. of Surrey. BC, Canada to calculate a National Instrument 43-101-compliant resource estimate, leading to a Preliminary Economic Assessment of the lithium-bearing zones at Gemini.

Gemini Lithium Project Borehole Locations, March 2022 to April 2023

In addition to the lithium-fertile western area of Gemini, the 2016 and 2022 geophysical results indicate continuity of the conductive zones in the eastern part of the Project, where these untested zones appear to be mapping the lithium-bearing stratigraphies intersected in the Phase 1 and Phase 2 drilling.

On June 5, 2023, Nevada Sunrise announced the results of metallurgical testing carried out on lithium mineralization from Gemini. A novel method of small-scale column testing achieved a 90.2% lithium extraction rate under the direction of Willem Duyvesteyn, of Extractive Metallurgy Consultancy LLC, based in Reno, Nevada. Mr. Duyvesteyn utilized the facilities of McClelland Laboratories Inc. (“McClelland”) in Sparks, Nevada for the metallurgical tests.

Highlights of Gemini Metallurgical Testing

- Preliminary leaching test work was designed to focus on obtaining a lithium leach extraction of more than 80%. Early tests included a standard sulfuric acid leach, the re-leach of residues, a hot acid beaker leach of low and high-grade mineralization, and a gypsum/lime roast water leach;

- Following the use of various extraction methods an “acid-bake” step was implemented using concentrated sulfuric acid on moist lithium-in-sediment mineralization with average lithium values of approximately 1,100 parts per million (“ppm”) lithium;

- A one-meter-tall column was loaded with Gemini clay mineralization and an open-circuit system employed a two-step leaching system, which achieved a 90.2% lithium extraction over a 25-day period.

The 90.2% lithium extraction rate achieved from the Gemini mineralization compares favourably with the average lithium extraction of 84% reported by Lithium Americas at its Thacker Pass lithium project (Source: Feasibility Study, National Instrument 43-101 Technical Report for the Thacker Pass Project, Humboldt County, Nevada, USA, by Roth, D., et al, dated November 2, 2022.) As follow-up to the successful outcome of this small-scale column testing, Mr. Duyvesteyn has designed a larger-scale test involving 50 kilograms of Gemini clay mineralization, which began in late May 2023. The larger test will employ selected higher-grade mineralization averaging approximately 2,000 ppm lithium.

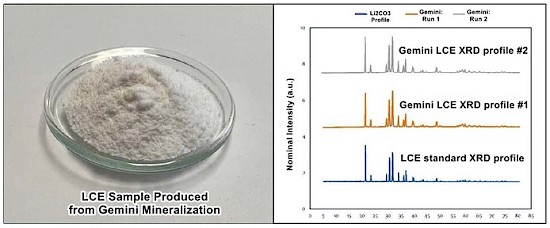

On July 31, 2023, Nevada Sunrise announced further results of metallurgical testing carried out on lithium mineralization from Gemini. A substantially pure sample of lithium carbonate equivalent (“LCE”) was produced from the leach solutions that realized a 90.2% lithium recovery rate reported by the Company in June 2023.

From the leach solution provided by the initial extraction, McClelland produced an LCE sample that was near-100% lithium carbonate (Li2CO3);

- Subsequent X-ray diffraction analysis (“XRD”) matched the standard pattern of lithium carbonate (see Gemini LCE XRD profile comparison to recognized Li2CO3 XRD profile below1).

1 Lithium carbonate precipitation by homogeneous and heterogeneous reactive crystallization, (Han, Bing; Anwar Ul Haq, Rana; Louhi-Kultanen, Marjatta, 2020)

Mr. Duyvesteyn and McClelland are carrying out further studies to assess the production of high-purity lithium carbonate from the column leach solutions. Both conventional precipitation methods and a modified direct lithium extraction (“DLE”) technique, utilizing proprietary lithium absorbents are under consideration.

Testing carried out by McClelland on lithium-in-water samples collected from the 2022-2023 drilling at Gemini has revealed that the presence of suspended, sub-micron-sized clay particles carrying lithium are not amenable to a DLE extraction process. Nevada Sunrise will continue to collect and analyze water samples from future drilling programs to evaluate potential for a DLE process on the groundwater encountered at Gemini.

Gemini 3-D Model

On December 11, 2023, Nevada Sunrise released an animated 3-D geological and geophysical model (the “Model”) for Gemini.

The 3-D model was produced by Walker Lane Research Partners, LLC (“Walker Lane, LLC”) of Oak Harbour, WA, based upon the results of detailed gravity surveys performed in the Lida Valley in 2012-2013 by a team from the University of Texas Dallas (“UT Dallas”), led by Dr. John Oldow, Ph.D. Dr. Oldow, a technical advisor to Nevada Sunrise, retired from UT Dallas in 2018 and is a cofounder of Walker Lane, LLC. His proprietary gravity data and geological determinations were combined with the results of TDEM surveys carried out by Nevada Sunrise in 2016 and 2022 to produce the Model. A still image taken from the Model is shown in Figure 1 below and the entire animated Model can be viewed here:

https://player.vimeo.com/video/892764870

Figure 1. Still image from the Gemini animated 3-D Model, with TDEM and drillholes

Dr. Oldow’s recommendations for additional work include increasing the gravity data coverage for the Gemini basin to further improve understanding of the basin geometry and where to locate drill sites to optimize exploration for both lithium brine and lithium-in-sediments. Identification of internal basin faults will be an important part of the additional exploration work. As found in the only producing lithium mine in the United States located at Silver Peak, Nevada in the Clayton Valley to the northwest of Gemini, internal basin faults impart important control in fluid flow and localization of lithium brines, and also have critical control on lithium-in-sediments facies distribution. Combining a better overall basin geometry with the TDEM profiles together with the existing drill logs should allow better constraint of the internal geometry in the Gemini basin.

About the UT, Dallas Gravity Survey1

The Lida Valley basin is bounded and crosscut by a rectilinear array of faults that emanate from the Sylvania Mountain fault system and transfer displacement to the Mount Jackson Ridge fault zone, which is part of the Palmetto Wash fault system. The Lida Valley is a pull-apart structural system with extension localized on north-northeast faults and transcurrent displacement on west-northwest faults. The combination of mapped faults and subsurface faults inferred by gravity data indicate an internal geometry that is substantially more complex than most pull-apart basin systems. The system of faults within the basin is composed of fault relays and transfer fault systems that segment the basin into three structural domains. Faults within each structural domain exhibit a tendency to curve along strike and to merge with other faults, resulting in an intricate array of kinematically linked structures that transfer displacement through the basin (Figure 2).

Figure 2. Still image from the Gemini animated 3-D Model, showing gravity anomaly

To describe the subsurface geometry of Lida Valley, gravity data were collected and a residual complete Bouguer anomaly was generated. Prior to this study, data coverage for Lida Valley and the surrounding region, provided by the Pan American Center for Earth Studies, consisted of 14 gravity stations within the Lida Valley basin and 60 measurements in the adjacent mountain ranges and intervening valleys. To improve spatial coverage approximately 500 gravity measurements were collected at 300 metres-spacing along seven transects crossing Lida Valley. Access was limited by dense sagebrush and, for the most part, the lines followed primary and secondary roads and in a few locations were acquired by tracking cross country. To ensure internal data consistency, a common station was reoccupied at all line intersections.

The data were collected using two Scintrex CG-5 gravimeters with station locations determined using dual-frequency Leica GS10 global navigation satellite system (“GNSS”) receivers. All 500 station values were referenced to a common base station that was measured by both gravimeters at the beginning and the end of each day. A secondary base station, located at the GNSS base station, was also measured by both gravimeters daily. The gravity base station was referenced to an absolute gravity station, Las Vegas K 169, in Las Vegas, Nevada.

1 Source: Late Cenozoic displacement transfer in the eastern Sylvania Mountain fault system and Lida Valley pull-apart basin, southwestern Nevada, based on three-dimensional gravity depth inversion and forward models (Sarah B. Dunn, John S. Oldow, and Nicholas J. Mueller, Department of Geosciences, University of Texas at Dallas)

Gemini Maiden Resource Estimate

On January 23, 2024, Nevada Sunrise announced the completion of a maiden resource estimate for Gemini within the regulations of NI 43-101 by ABH Engineering Inc. of Surrey, BC, Canada. Nevada Sunrise plans to file the Technical Report within the next 45 days. It comprises a detailed review of the completed exploration programs, an Inferred resource estimate, interpretations and conclusions and recommendations for the next phase(s) of work.

The Gemini resource estimate was based on geochemical analyses for lithium from composite samples of material collected from the rotary splitter in the RC drilling rigs contracted by the Company, which produced a continuous, representative 3 to 5 kilogram sample for each sample interval. Results of the drilling proved the existence of clays mineralized with lithium, exhibiting very good geological continuity; the Inferred resource was calculated for lithium carbonate hosted in the clays.

Highlights of the 2024 Gemini Inferred Resource Estimate

- 2022-2033 drilling at Gemini was based on targets selected from geological mapping and geophysical surveys that included a detailed gravity survey and two TDEM surveys.

- Two phases of drilling were completed in five (5) RC holes totaling 7,330 feet (2,234.18 metres):

- Phase 1 drill holes GEM22-01 and GEM22-02 totaled 2,020 feet (615.85 metres);

- Phase 2 drill holes GEM22-03, GEM23-04 and GEM23-05 – 5,310 ft (1,618.49 metres);

- Drilling to date has tested only a small portion of the Project area within 844 acres, (342 hectares), which represents approximately 15%, of the area covered by the 5,600 acres (2,266 hectares) of Bureau of Land Management unpatented lode claims.

-

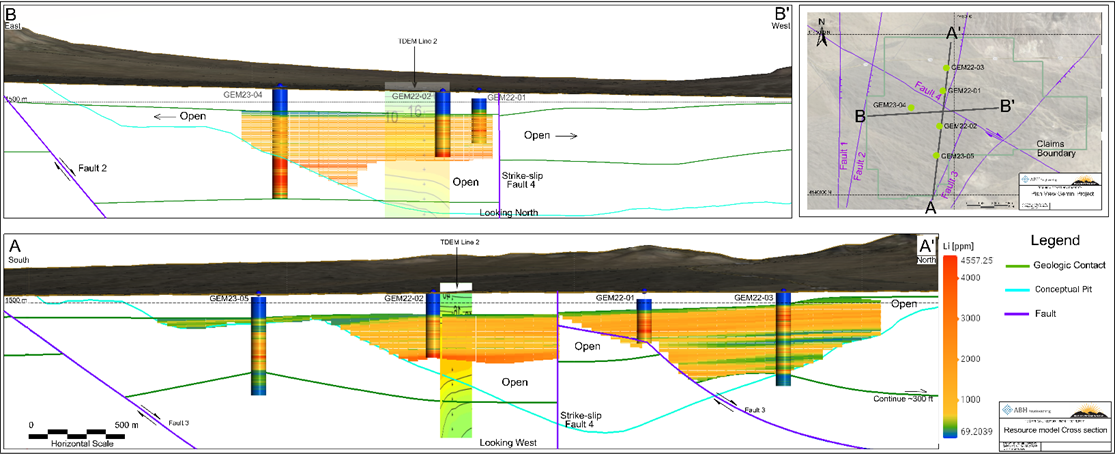

The deposit remains open in all directions and at depth. The Inferred resource estimate comprises, in an open pit-constrained resource:

- Approximately 1.3 million tonnes Lithium, or 7.1 million tonnes lithium carbonate equivalent (“LCE”) contained within 1,200 million tonnes of lithium-mineralized clay at an average grade of approximately 1,130 parts per million (“ppm”) Lithium;

- Lithium cut-off values of 400 ppm Lithium and density of 1.7 grams per cubic centimetre (“gm/cm3”) were used;

- Model constraints: Faults 3 and 4; a conceptualized 24 degree pit-slope, modelled from property boundaries, using a benchmark 24 degree pit-slope from several other Nevada lithium clay deposits.

Gemini Lithium Project – Block Model Cross Sections with Conceptualized Open Pit (Source: ABH Engineering Inc.)

“We are very pleased that the maiden resource estimate has exceeded expectations,” said Warren Stanyer, President and CEO of Nevada Sunrise. “With only five holes drilled to date in just 15% of the project area, Gemini has emerged as one of the world’s largest lithium resources, and the fourth largest in the United States. We look forward to additional exploration at the Project to effectively expand the size of the resource, leading to the production of a preliminary economic assessment.”

NI 43-101 Technical Report Resource Estimate for Gemini Lithium Project: Link: https://nevadasunrise.ca/projects/reports

The technical information contained in this disclosure has been reviewed and approved by Damir Cukor, P. Geo., who is a Qualified Person with respect to Nevada Sunrise’s Gemini Lithium Project, as defined under NI 43-101.

Sediment Sample Collection and Analysis

Sediment samples described in this new release are a composite of material collected from the rotary splitter in the RC drilling rig, which produces a continuous, representative 3 to 5 kilogram sample for each sample interval. Samples were submitted to American Assay and ALS Global USA in Reno, NV and were analyzed utilizing a multi-element ICP-AES method. Specifically, the analytical method involves aqua regia digestion of the sample followed by the inductively coupled plasma (ICP) technique to ionize the sample, and atomic emission spectrometry (AES) to determine elemental concentrations. Duplicates, field blanks, and certified reference standards were inserted at regular intervals in the sample stream to ensure accuracy of the analytical method.

Water Sample Collection and Analysis

Water parameters including TDS, conductivity, temperature, and pH values were obtained in the field by direct measurement with a handheld YSI556 Multi-parameter water meter, which meets Good Laboratory Practice (as proscribed by the Organization for Economic Cooperation and Development) for calibration and measurement.

Groundwater samples were collected at 20-foot (6.1-metre) intervals and sent to Western Environmental Testing Laboratory in Reno, Nevada under project chain-of-custody protocols for analysis. Industry standard methods for examination of water are employed by the laboratory. General chemistry testing may include analysis for specific gravity, total hardness, total alkalinity, bicarbonate, carbonate, hydroxide, total dissolved solids (TDS) and electrical conductivity. Lithium is analyzed by inductively coupled plasma-optical emission spectroscopy (ICP-OES) methods.

The scientific and technical information contained in this disclosure has been reviewed and approved by Willem Duyvesteyn and Robert M. Allender, Jr., CPG, RG, SME and a Qualified Person for Nevada Sunrise as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.